Chart of Accounts

Introduction

When charities are in the process of implementing a new finance system, one of the major areas for consideration must be the Chart of Accounts (CoA) and its structure.

A well thought out CoA will provide the following on both a summarised and detailed transactional level:

- Structured SoFA Reports

- Income and Cost Trend Analysis

- Award and Grant Analysis

- Budget Management

- Cash Flow

- Internal Reporting

A change of finance system provides you with the perfect opportunity to review the existing chart and consolidate / re-design to facilitate any changes within your organisation since the last CoA review.

This potentially isn’t a quick task – however it is extremely important and will clear any historical reporting issues you may have experienced.

Based on several years of implementing financial systems within the marketplace, we would offer a number of observations in relation to creating a CoA specific to the Charity / NfP sector.

Structured SoFA Reports

Before designing the CoA, always refer to the final SoFA report output to ascertain what must be considered in the overall structure.

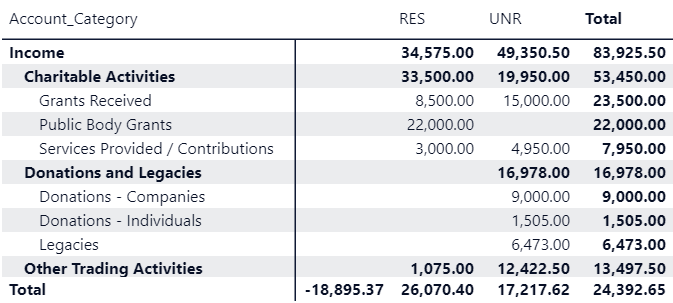

For example, best practice would be to use sub-categories and Parent/Child relationships within the CoA to group individual account codes into the relevant headings within your SoFA report itself. This will allow you to see summarised groupings of account codes, but also the individual balances themselves as shown below:

Income and Cost Trend Analysis

When thinking about Income and cost matching, it is recommended to use your CoA numbering sequence in a logical way whilst always leaving you room to grow and add in further codes without causing any reporting disruption.

Try to structure your codes accordingly and with the same numbering sequence. For example, Revenue Codes can all begin with the same number (e.g. 1****); likewise, for Expenditure (e.g. 2****). Matching income/expenditure codes that can be structured using common values for the remainder of the code – for example, the code for “Shop Sales Revenue” might be 10001 with “Shop Sales Cost” as 20001. This approach can be implemented across your whole Income Statement and Balance Sheet.

This will allow you to match the end codes and produce mini Income Statements for each revenue type and quickly see the trends over your chosen time periods.

Award and Grant Analysis

As discussed above, it is important when creating your CoA structure around Awards and Grants, to understand the associated reporting required for SORP compliance and Trustees.

Using the Parent/Child relationship, customers must not be afraid to have the correct level of granularity, safe in the knowledge that summarised reporting is available. Separating award and grant types within your CoA will enable a more detailed analysis of how these are being distributed.

Budget Management

The key element within your CoA is ensuring that internal budgetary control is easy to manage.

Having a structured CoA allows for segmented reporting to be available for your different types of budget holder. For example, if budgeting by Cost Centre, ensure your CoA reflects this, therefore allowing you to provide only the account codes relevant to your budget holder, instead of providing a full list of accounts where the budget holder has to extract their account codes.

This will also ease the process of consolidating all the individual budgets together, thereby reducing the risk of any double counting.

Cash Flow

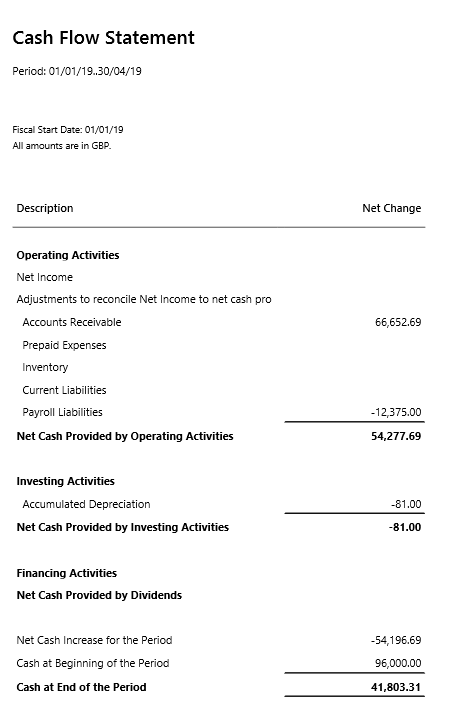

In relation to Cash Flow, the use of sub-categories and Parent/Child relationships will enable both summarised and detailed cash flow reporting to an individual account level.

For example, using the sub-categories within the balance sheet of “Accounts Receivable”, “Prepayments”, “Inventory” etc. will ease the Cash Flow reporting process and provide a SORP Compliant reporting structure as shown below:

Internal Reporting

Although external reporting is critical, you should also consider internal reporting when it comes to your CoA structure.

Individual Cost Centre or Departmental managers will request their own reports for the day to day running of your organisation. The CoA structure must cater for this in as easy a manner as possible. Using the guidance in each of the areas above, you will be able to meet all internal reporting requirements.

Summary

Your CoA structure drives all your business transactions and reporting requirements, both internally and externally.

The key element within the whole process is to keep it simple and structured. Try to avoid having numbering sequences that do not flow within an Income Statement or Balance Sheet.

It is essential not to limit yourself when creating your CoA. Always leave room within the coding structure for growth or organisational change.

Don’t adopt a different approach for internal reporting, using the techniques and guidance provided above, you should be able to meet all internal and external reporting requirements and any future growth.

Authored by Daniel Booth and Sunita Chandnani