Customer Insights

Introduction

All NfP organisations hold vast amounts of data relating to and collated from, a number of different sources and systems. Making sense of all this information is one of the biggest challenges faced, before being then able to utilise and gain future on-going benefits from the records you hold.

It is no understatement to say that being able to do this is critical to your future successes and based on our experiences within this area, we can offer our guidance in what to look out for, and areas to focus on to assist you in getting a clearer view of your data.

What exactly is “Customer Insights”?

The word “Customer” isn’t just for business and commercial organisations, NfP customers are donors from which incomes are received.

In order to get the full potential out of your “Customers”, be them businesses, donors or public bodies, you must understand every element of their interactions with you.

Your individual systems may hold different types of information against a customer, i.e your ERP system holding financial information whilst your Customer Relationship Management system holds contact details and interaction activity. However, these only look at one angle of your relationship with that customer.

Customer Insights should include all elements from all your data sources relating to your customer be them financial, transactional, observational or behavioral, and provide insights that drive and focus your organisational processes.

Who benefits from Customer Insights?

Every stakeholder within your organisation will benefit from accurate customer insights from your customers to trustees.

Customer Insights will provide not only historical information but can be used for accurate forecasting of future intent dependent on various factors that your organisation encounter.

The aim of organisations using customer insights is to become proactive to predict scenarios instead of being reactive to change, therefore ultimately giving a competitive edge when it comes to securing future incomes.

Area’s of Focus

The 3 key areas to focus on as organisations are around the quality of data, and what tools to use to get the data into meaningful insights.

These are as follows:

- Managing your Data Sources

- Know what you want to get out of customer insights

- What tool or platform to use

Managing your Data Sources

For Customer Insights to work in a meaningful way, you must have common references against your records across all of your systems that can unify it to the data from all outputs.

If this doesn’t exist at present, we would recommend for your systems to be amended to include this. It doesn’t have to be painful… all that is required is for you to create a new field or use an existing field that is currently blank within your business forms.

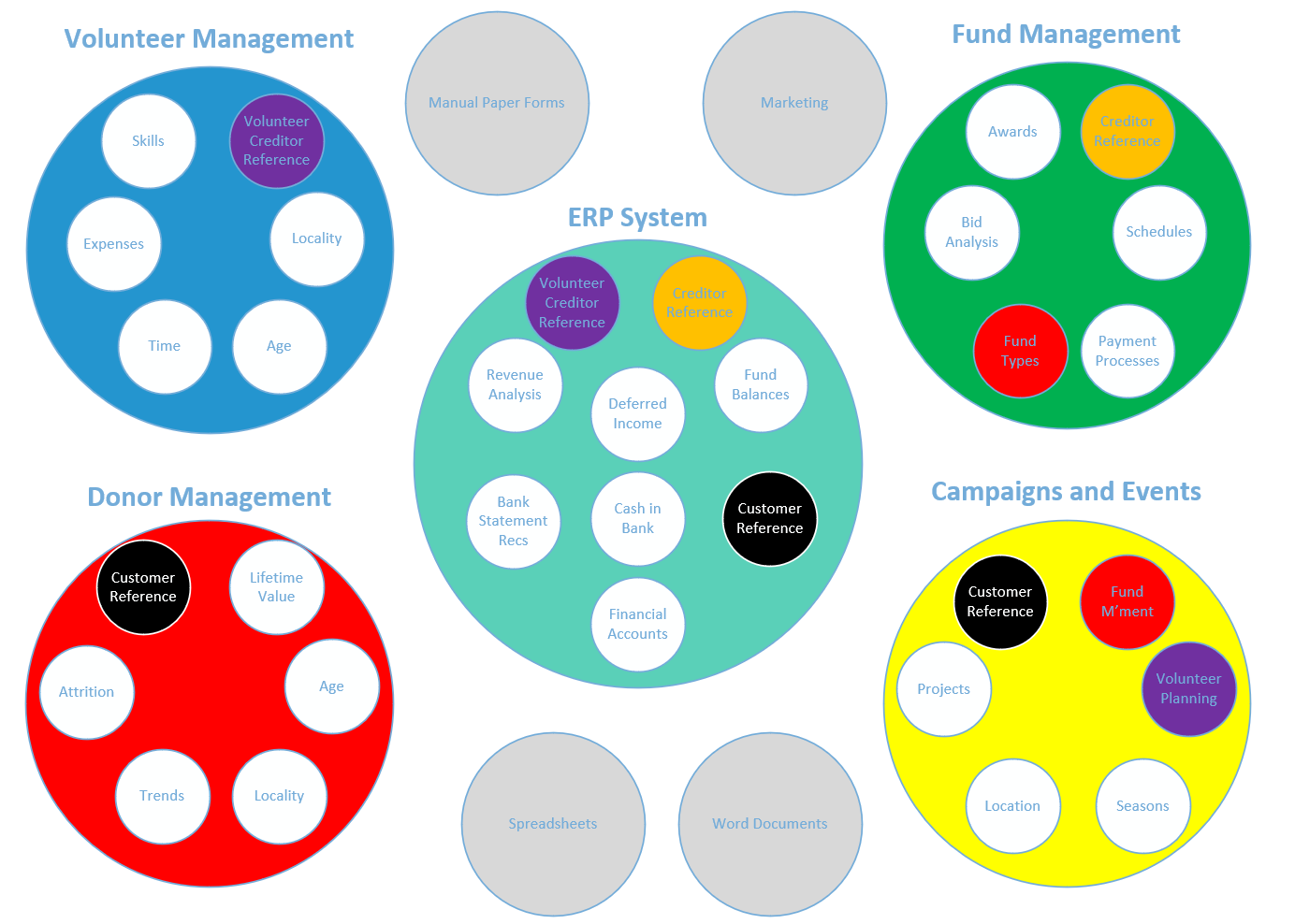

The diagram below highlights just how this can work, using common references (colour coded), you can see how the different platforms can integrate to give full insights into every element of the data you hold.

What system to use?

There are a number of consolidation tools to assist in providing you with Customer Insights – but be aware, the cheapest options may not provide you with the best outputs.

Don’t fall into the trap of thinking you can achieve advanced reporting by a series of lookup tables in Excel, no matter how advanced your user(s) may be.

At the other end of the scale, the dedicated Customer Insights based programs may be too large or expensive for your requirements.

There is a wide choice of systems available, with many of the reporting and analytical platforms more than capable of meeting and exceeding your insight needs.

As with any system purchase, do plenty of research into what platform will benefit you the most both immediately and with the capabilities to go further as your organisational requirements around customer insights change.

Summary

NfPs are completely reliant on the generosity of others, therefore must understand every individual as much as they can, being flexible and quick to react on any changing traits.

Consistency in data is essential starting with the initial transaction entry, having lots of different entry points, in lots of different formats makes understanding very difficult. Therefore, having common fields between systems makes bringing all your data together to form a 360-degree view of your customers/donors possible.

Having Customer Insights available to your organizations enables you to understand every element of your Customers / Donors income trends and behavioural traits – with the data all being in one place, thus enabling you and your organizations to spend the time doing what you do best – increasing income!

Authored by Daniel Booth